straight life policy cash value

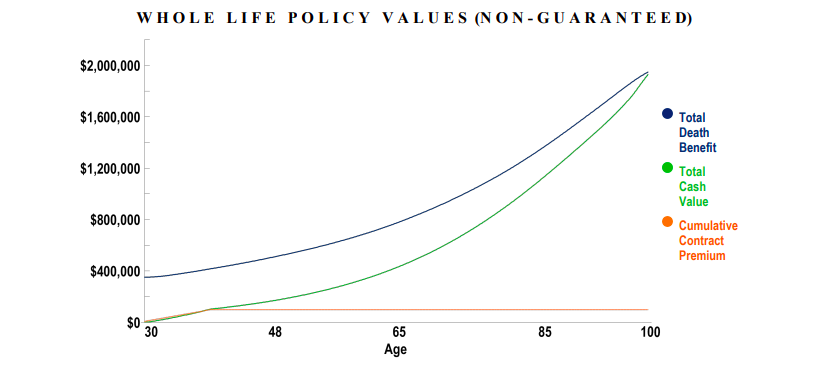

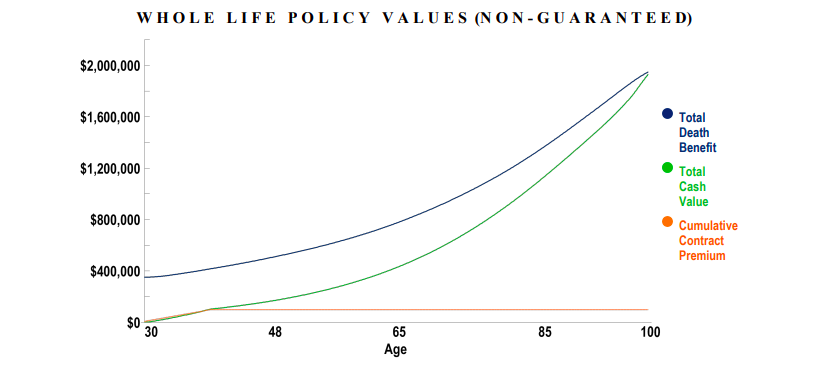

Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums. This is because as the cash value of straight whole life increases the actual insurance coverage being paid for by the policy owner is reduced.

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

See if you qualify in under 10 Minutes.

. This is a straight life annuity that starts paying you back as soon as you acquire it. The face value of the policy is paid to the insured at age 100. His insurance agent told him the policy would be paid up if he reached age 100.

Get the info you need. Rob purchased a standard whole life policy with a 500000 death benefit when he was age 30. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Use It For a Better Life Retirement. A straight life insurance policy can also build cash value over time. The cash value grows slowly tax-deferred meaning you wont pay taxes on.

Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Initial Targeted Cash Value. Straight life policies are often.

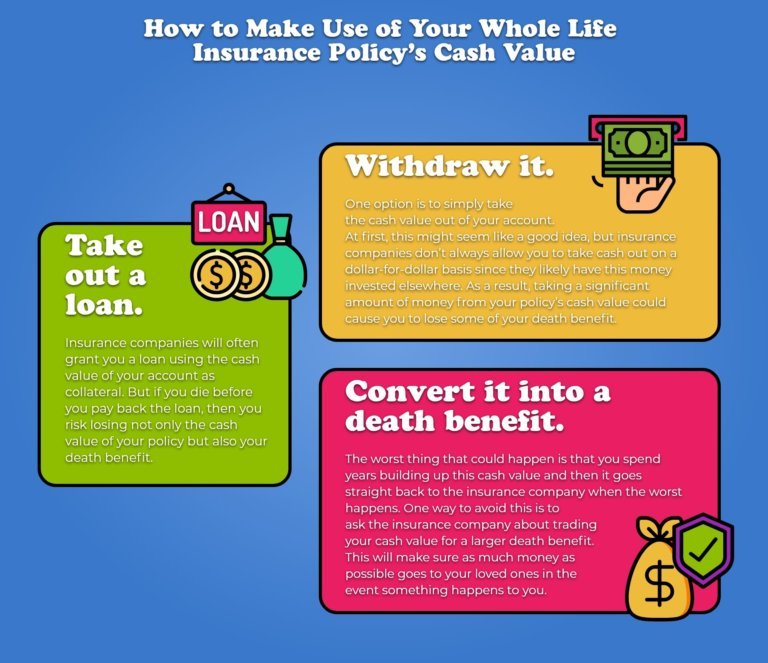

Principles Life and Work Ray Dalio. It also gives policyholders the ability to take advantage of outside investment opportunities through policy loans. Whole life insurance cash value grows throughout the life of your policy.

The cash value is an interest-earning account inside of your straight life insurance policy. 2022s 10 Best Life Insurance Prices For Policies That Will Cover Your Loved Ones. B An Accelerated policy.

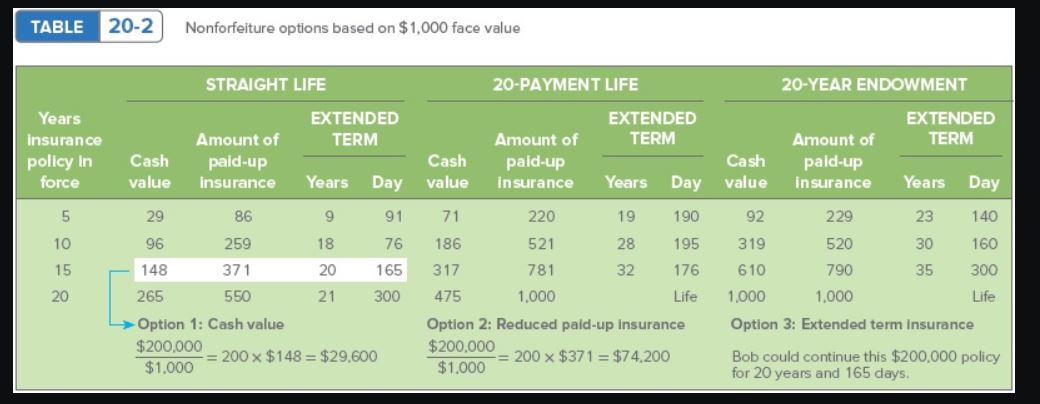

The face value of the policy is paid to the insured at age. Ad Cash in your life insurance policy. Which of the following could be a future use of cash value that builds in a recently-purchased whole life insurance policy.

Also known as whole life insurance a straight life policy has a cash. This cash value provides a living benefit you can access while youre alive. Universal life insurance is a type of.

Straight whole life insurance require more premium than term life insurance policies for the same death benefit in the early years of a policy and less premium than term life insurance in later years. Also known as whole life insurance a straight life policy has a cash. With cash value life insurance your premium payments go.

Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. Variable life insurance is a type of permanent life insurance with a cash value and with investment options that work like a mutual fund. The cash value of a straight life policy grows like one.

Convert the cash value to a paid-up term policy. The whole life provides lifelong coverage and includes an investment component known as the policys cash value. Into the cash value.

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

The 7 Types Of Life Insurance Policies What S The Best One For You

Solved Calculate The Cash Surrender Value For Lee Chin Age Chegg Com

What Is A Straight Life Policy Bankrate

Is Cash Value Part Of The Death Benefit Infographic Fig Marketing

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition How It Works With Examples

What Is A Straight Life Policy Bankrate

Straight Life Insurance New York Life

What Are The Principal Types Of Life Insurance Iii

Chapter 12 Life Insurance Ppt Download

The Average Cost Of Life Insurance African Eye Report

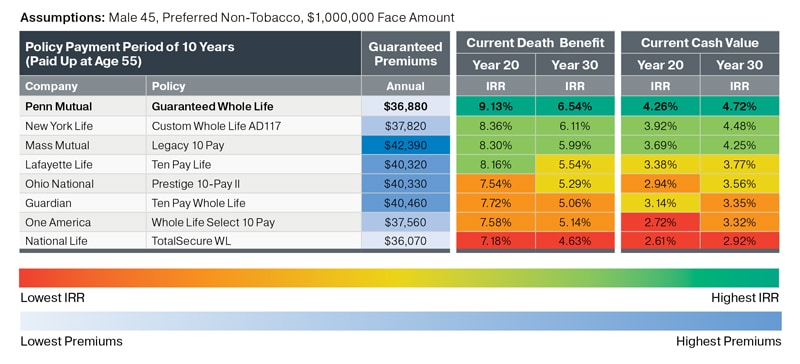

Best Dividend Paying Whole Life Insurance For Cash Value Why Banking Truths

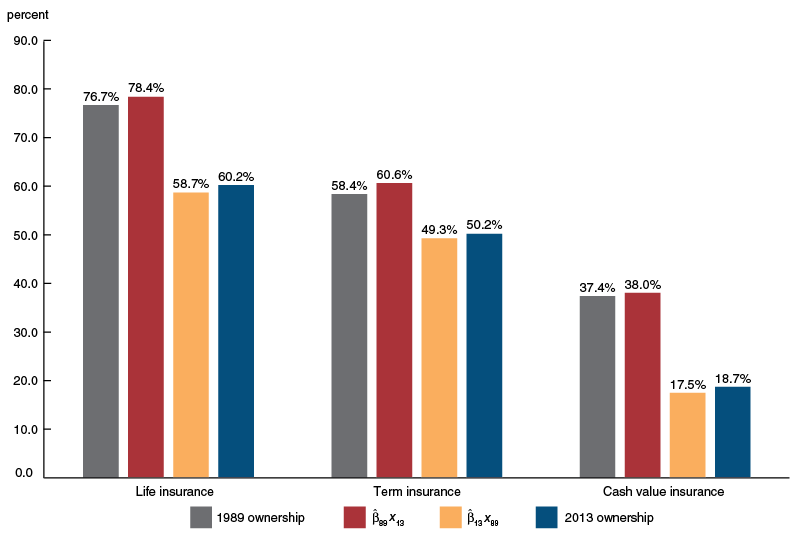

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

Should I Cancel My Whole Life Insurance Policy White Coat Investor

Limited Pay Whole Life Insurance What Is It See The Numbers

What Is Cash Value Life Insurance Smartasset Com